15 Questions to Ask Before You Buy Anything

Part of the debt free journey is doing whatever you can to increase income and reduce expenses. And in the process of digging yourself out of debt, you may find yourself selling everything you own to try to earn enough money to free yourself even faster.

We have definitely listed lots of things for sale online as part of our debt free journey. And thinking that we mindlessly bought so much stuff that just cluttered our home and didn’t add any true value to our lives makes me sick. Why did we buy all this stuff in the first place?!

This debt free journey has caused me to examine my life in so many ways, one of which, is obviously how and why I spend money. I’ve finally begun to realize that money is a valuable asset that should never be squandered and that it should be spent in a way that aligns with my priorities and values in life.

And what I’ve discovered is that I typically don’t spend any money on the things I love the most. Two of the things I love most in life are theatre and travel, but I never spend money on these things. Once we are completely debt free, we are taking a big family vacation and buying season tickets to the theatre—and I won’t feel one bit of guilt, because these are the things I want to spend money on. (As opposed to fast food for the millionth time, which—let’s face it—adds 0 value to my life).

Money is a valuable asset that should never be squandered and should be spent in a way that aligns with your value and priorities.

In other words, I’m so over buying things because I had a hard day and “I deserve it.” You know what I deserve? To live a life free from debt. To experience financial freedom. To have options and peace and opportunity to live the life exactly the way I want it. And those things, my friends, are so much more valuable than any thing you could ever buy in a store.

So today, I’m encouraging YOU to start examining why and how you spend your money. And I’m encouraging you to spend your money in a way that aligns with your priorities and values in life.

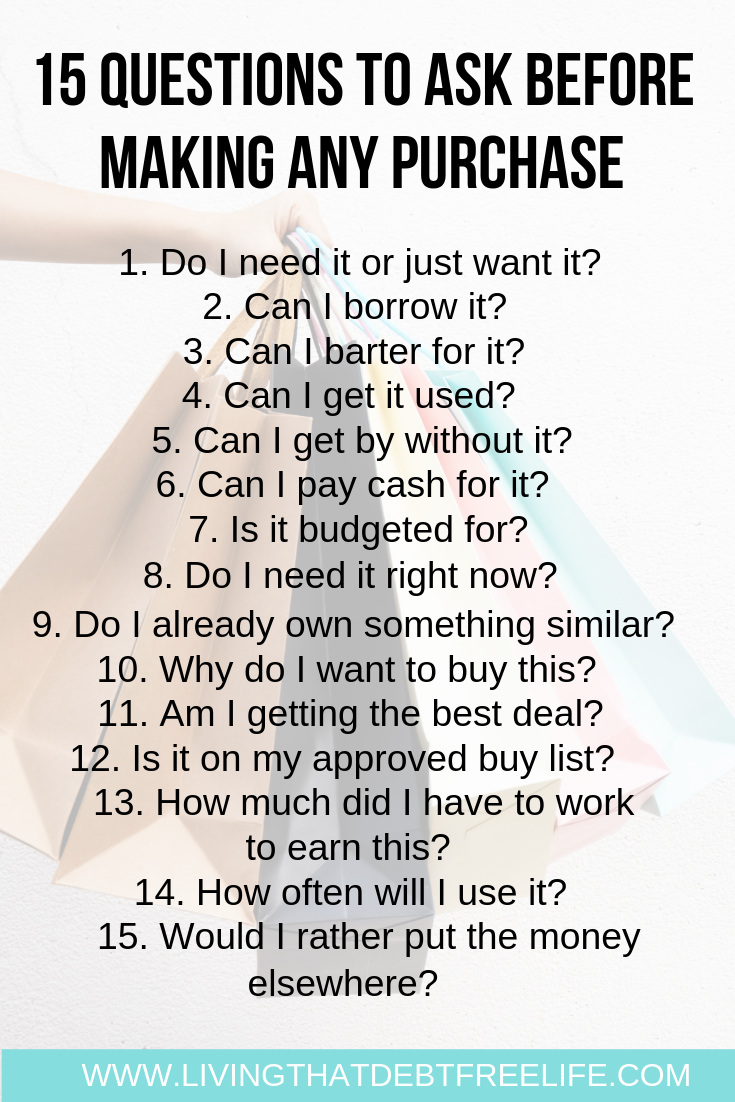

To help you on your way, I’ve listed 15 things you may want to consider before making any purchase.

15 Questions To Ask Before Making Any Purchase

1. Do I need It or Just Want It? One of the quickest ways to free yourself from debt is to limit your spending to only the essentials. True, honest to goodness, real essentials. If you don’t absolutely need it (and spoiler alert: there’s probably very little you absolutely need that you don’t already have), then you should consider not buying it. Plain and simple.

2. Can I Borrow It? If it is something you need, maybe you can borrow it and save yourself the expense. Can you borrow the item from a friend or a neighbor? Consider using the library for books, audiobooks, and even movies. Borrow that power tool you only need to use every so often from a friend.

3. Can I Barter for It? Maybe you can save the expense by bartering. Is there a special skill you can offer? You don’t even have to be especially talented to barter. Think about offering to babysit or drive the carpool to soccer practice. Maybe you can babysit the neighbor’s kids in exchange for them power washing your driveway/repairing your car/painting your guest room/whatever skill they have to offer.

4. Can I Get It Used? There is a gold mine of stuff to be found at totally bargain prices if you are willing to wait. Try looking on Facebook Marketplace (my fave), your local Goodwill or secondhand shop, eBay, Craigslist, or Poshmark. The list goes on and on.

5. Can I Get By Without It? Is it something you absolutely have to have? Or is it just a “nice to have?” Often times the things we think we need, we really can get by without. See number 1, above.

6. Can I Pay Cash For It? If you’ve been around this blog longer than 5 seconds, you know I’ll never tell you to go into debt for anything. Except your home. Financing anything is a risk I just don’t want to take in my life anymore—and it’s a risk I recommend you ditch from your life, too. If you can’t pay cash for it, you can’t afford it. Period.

7. Is It Budgeted For? This is a rule I admit I’m sometimes guilty of breaking. But, it’s also one that helps keep me in line when I want to splurge sometimes. The beauty of doing a zero-based budget, is that it’s hard to make unplanned purchases. So, if it’s not in the budget, and if you haven’t planned for it, buying it may throw your whole budget off. If you haven’t budgeted for it, don’t buy it! Make a plan to pay for it and budget for the expense properly.

8. Do I Need It Right Now? If you can delay an expense, you’d be surprised how often you no longer want the item after a little time has passed. If you don’t need it right this instant (and honestly few things short of diapers, toothpaste, and toilet paper fit this bill), consider adding it to a “purchase pause list.” Wait 24 hours before buying it and see if you even still want it.

I take this a step further and keep a 30-Day Buy List in the notes section of my phone. I write down what I want and the date, and then I visit the list periodically to see if I still even want the thing.

Here we are in June, and there are things on that list from last November that I still haven’t purchased. Worse still—there are things on the list that I don’t even recognize. Case in point: the Everlane Day Market Tote in Cognac. Sure, it’s a bag I wanted at some time, but sitting here right now, I can’t even tell you what that bag looks like.

What does all this tell me? I guess I didn’t want that stuff that much after all. And what’s even better? I didn’t spend my money on any of it.

9. Do I Already Own Something Similar? I’m looking at you 432 pairs of black yoga pants! Before you spend money buying something new, ask yourself if there is already something similar you own that could get the job done. Be resourceful.

10. Why Do I Want to Buy This? This is a big one, guys. Before you buy something, ask yourself—really ask yourself why. And keep asking why until you figure it out.

Why do you want to buy this thing? What do you think it will give you that you don’t have now?

Will it make you feel happier, prettier, more powerful, make you feel like you fit in, like you belong, like you’ve finally made it? Are you buying it just because you think people will like you more or be impressed by you because you own it? Are you compensating for something you are embarrassed about or ashamed of?

It’s taken me years to figure this out, but buying something you don’t need won’t enrich your life. In fact, it’ll do quite the opposite. It’ll clutter up your home, force you to spend more time and money taking care of the multitude of things you own, and potentially cause you to go into debt, thereby forcing you to work more and more to be able to pay off your past, prolonging your ability to live the life you really want.

11. Am I Getting The Best Deal? I heard a saying a while back “Any idiot can pay full price.” It made me laugh, but also caused me to think. Now, I’m not nearly as frugal as I’d like to be. Frugality was never my original goal—debt freedom was. But the two do go hand in hand, and I’m learning more about frugality as I continue my debt free journey. All that to say, there are tons of people out there who ARE frugal—far more so than me, and they know that getting a good deal on the items you purchase is key. Use coupons, cash back apps, look for it used or on sale. And remember, any idiot can pay full price.

12. Is It on My 30-Day Buy List? I talked about my 30-Day Buy List, above. But you don’t have to be that extreme. May try a week or 24-hours. Simply imposing a waiting period before you make a purchase will ensure you’re only buying the things you truly want. So before you make that next purchase, ask yourself if it’s on your buy list.

13. How Much Did I Have to Work For This/How Many Hours of My Life Does this Equal? I learned this concept from the book Your Money or Your Life. The book advises you to think of purchases in terms of hours of your life. Because, after all if you must work for money, like most of us do, you ARE purchasing everything with hours of your life. And time is our most valuable resources—something that we can’t make more of, unlike money. So the next time you justify a purchase to yourself saying “It’s only $20,” you might want to consider saying “Is this worth working 2 hours for?” instead.

14. How Often Will I Use It? If you’re purchasing something that you’re only going to use once in a blue moon, it might not be the best idea to purchase it. If this is the case, consider borrowing the item. I did this recently when we got offered tickets to a Houston Astros game. I wanted to wear an Astros shirt to the game, but I didn’t own one. I sure wasn’t going to spend money buying a shirt that I knew I was only going to wear once. Instead, I asked a coworker to borrow one of hers. I got the result I wanted (wearing team gear to the game), and didn’t have to spend a dime. Frugal win!

15. Is This Purchase Worth Delaying My Freedom? And of course, perhaps the most important question of all. Before you buy anything, ask yourself “Do I want this thing more than I want debt freedom?” As Dave Ramsey says, “Don’t give up what you want most for what you want right now.” Stated another way, ask yourself would you rather put the money somewhere else?

In Summary…

Now, you don’t have to ask yourself ALL of these questions EVERY time you make a purchase. Simply having 1 or 2 of them in the back of your mind before you make a purchase may be all that you need to prevent impulse shopping.

Now, drop me a note below and let me know one thing you purchased that you regretted? Do you think this list would have saved you?

Don’t forget to Pin this for your friends by clicking one of the images below!