How To Start Budgeting When You Have No Idea What You're Doing

Of all the questions I get asked on Instagram, “How Do I Start?” is the question I get asked THE MOST. If you’ve never budgeted before or if you’re living paycheck to paycheck, the idea of getting started can seem pretty overwhelming. But, putting together a realistic financial plan that will work for YOU and help you meet your goals is really a lot easier than you may think. In this blog post, I’m going to walk you through everything you need to know to get started with your first budget. Let’s dive in!

STEP ONE - DETERMINE YOUR GOALS. A lot of people skip over this step, but it is a crucial first step in any successful financial plan. If you don’t know what you’re trying to accomplish with your budget, you’ll never get there. So take a few minutes to decide what your’e trying to accomplish. Are you trying to become debt free within 12 months? Save up to attend a friend’s destination wedding that’s 3 months away? Pay off your son’s braces by the end of summer? Put together a starter $1,000 emergency fund as quickly as possible?

Think about what made you decide to want to start budgeting. Whatever it is you’re trying to achieve with your money, write it down, and set a goal time-frame for making it happen. You’ll then design your budget in a way to help you meet those goals.

Start with your goals. If you don’t know what you’re trying to accomplish with your budget, you’ll never get there.

My Financial Freedom FlexPack contains tons of printables to help you on your way, including monthly planning sheets for you to set goals each and every month to help you stay on track financially.

STEP TWO - FIGURE OUT WHAT YOU OWE. This can be a really difficult step for some people to tackle. Lots of people—particularly those who have never budgeted before—are perfectly content to not know exactly how much debt they have. Hey, ignorance is bliss, right? Wrong! Gather up all your bills and bank statements, all your courage, and hey, even order a copy of your credit report - and figure out what you owe. Make a list of everything. Write down the creditor, the monthly payment, the total amount owed, the interest rate, and the due date.

Related: How to Pay off Debt with the Debt Snowball Method and How to Pay off Debt with the Debt Avalanche Method.

STEP THREE - FIGURE OUT WHAT YOUR MONTHLY EXPENSES ARE. Review everything you spend money on and make a list of all your monthly expense categories. You don’t have to allocate any money to any categories yet (you’ll do that in Step 8). Just work on getting a list of categories together. All the bills you gathered in step two should help. Another fantastic place to start is by pulling your bank statements for the last three months. Review them and figure out what you spend money on, on a monthly basis.

Once you’ve got your list ready, move on to step 4.

STEP FOUR - DON’T FORGET ABOUT ANNUAL EXPENSES. There are some things we only pay once a year—like wholesale club memberships, HOA dues, income taxes, or car registration fees. Don’t let these one-time annual expenses sneak up on you and bust your budget when you least expect it. Take some time to think about those expenses you only pay for once a year and write them down. Then budget 1/12 of that amount to add to your budget each month.

For example, our HOA dues are about $1200/year. I get paid twice a month, so every payday I put aside $50 for an HOA dues fund, or $100/month. When the due date rolls around, I can make the payment without stressing or trying to scramble to get together $1,200 in a single month.

My Financial Flex Pack contains an Annual Expense Tracker for you to record those expenses that arise just once per year. It even includes a list of 20 common annual expenses you may be forgetting.

Related: Six Reasons You’re Failing at Budgeting

STEP FIVE - FIGURE OUT WHAT YOU EARN. What’s your net take home pay from all sources each month? This includes side hustles, part time jobs, everything. Next, write down how often you get paid. Is is biweekly? Semi-monthly? Once a month?

STEP SIX - DECIDE WHAT BILLS WILL BE PAID FROM WHAT PAYCHECK. If you’re a paycheck budgeter like I am, making a plan for your money by the month, when you don’t get paid monthly, just doesn’t make any sense. If you don’t have a plan in place for your paycheck, how are you supposed to know what to do with that money when you get paid?

Using the due dates and the dates you get paid, your next step is to decide what bills need to be paid from what checks.

For example, I get paid twice a month, on the 1st and the 15th, and my cell phone bill is due on the 22nd. It comes from my paycheck on the 15th of the month.

Make a list of what bills will be paid from what paycheck. It may look something like this: Paycheck 1 = cell phone, car payment credit card. Paycheck 2 = mortgage, student loan, car insurance.

My list never changes because my pay days are predictable and always on the same days—the 1st and the 15th. If you are paid every other week or on a sporadic or unpredictable basis, you may have to repeat this step monthly.

I consult this list each time I get paid, so I know what bills need to come from what paycheck. Below is a printable from my Financial Freedom Flex Pack that will help you organized your bills by paycheck.

STEP SEVEN - CONSIDER THE HALF PAYMENT METHOD. This is when you take a regularly occurring payment, such as a $1,200 mortgage and divide it in half. You then take half of the total bill from each paycheck, set it aside, and pay the bill in full when it is due.

I do this for my $1,770 mortgage. So, I take $885 from my paycheck on the 1st and $885 from my paycheck on the 15th, and pay my mortgage in full on the 15th of the month before it is due.

This ensures two things: (1) I’m never late on the mortgage because I give myself plenty of time to pay it before it is actually due, and (2) I have plenty of money throughout the month.

If I had to take all $1,770 from one paycheck, that would deplete that paycheck pretty rapidly. I’d have little else for other expenses like gasoline or groceries.

(NOTE: This is different than biweekly mortgage payments, which I’ll talk about in an upcoming post.)

If you’re finding yourself pretty strapped for half the month, but living large and in charge the other half, consider dividing the money in your budget using this half payment method.

A zero-based budget is absolutely critical to managing your money, paying off debt faster than you ever thought you could, and meeting your financial goals.

STEP EIGHT - MAKE A ZERO BASED BUDGET. The day before you get paid or the morning of payday, make a zero-based budget for that paycheck, using the list you made in Step 6 as a guide.

A zero-based budget is a method of budgeting where you budget every single dollar of income, down to the penny. Made $1,000 this payday? Budget $1,000! Tell those $1,000 where to go, instead of wondering where they went.

Do not skip this step! This is the important part, obviously! A zero-based budget is absolutely critical to managing your money, paying off debt faster than you ever thought you could, and meeting your financial goals.

When you’re making your budget, remember to revisit the goals you made in Step 1. If getting out of debt is your top priority, you’ll send every spare penny to debt. If establishing your emergency fund ASAP is your goal, you’ll send every extra penny to savings. If your goal is to attend your cousin’s wedding in Kansas in 3 months and you need $300 for a plane ticket, you’d better set aside $100/month in your budget.

For all the nitty gritty details on making a zero-based budget, see this post for everything you need to know.

The budget sheets below (monthly and paycheck editions) are part of my Financial Freedom Flexpack and will help make creating your first (or next) zero-based budget so much easier.

And, by the way, the zero-based budget is THE NUMBER ONE TOOL that my husband and I used to help us send almost $95,000 to debt in the last 29 months. I’ve created a FREE guide that talks about the 9 proven steps we took to pay off debt faster than I ever thought possible. You can get your free copy by signing up below!

STEP NINE - DIVIDE YOUR MONEY. Whether you’re using cash envelopes, virtual envelopes, or some other budgeting app, you need to divide your money among your budget categories. Either physically or virtually, or some combination of the two, actually divide your money among your budget categories.

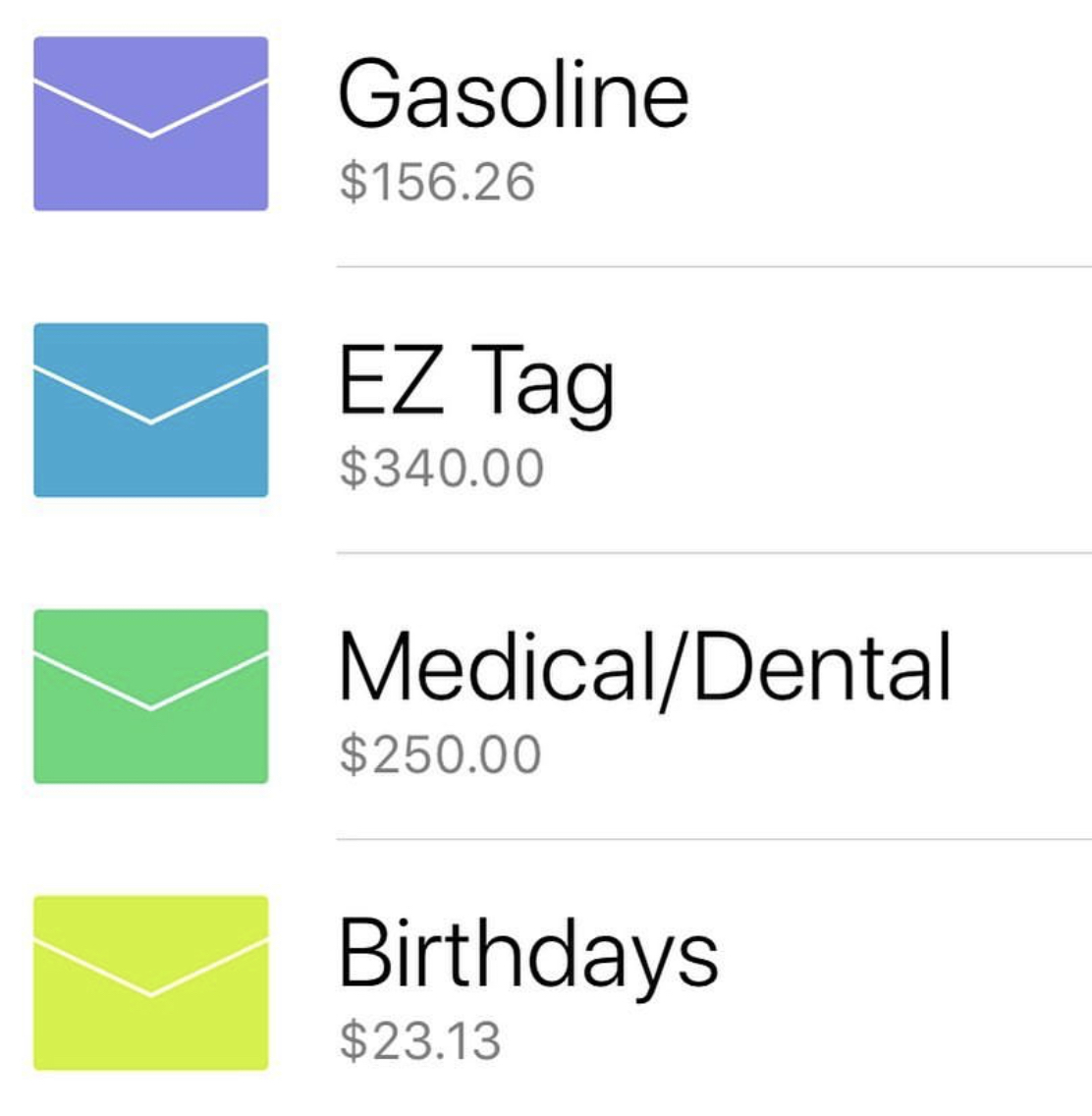

I use virtual envelopes to manage my money through an app called Envelopes Budget Manager, (currently for iPhone only) to divide my money among virtual envelopes. AND I HIGHLY RECOMMEND this app. I honestly could not function without it. It does cost a one-time fee of $7, and I think this is the only app I’ve ever actually paid for, but it is worth every dime. (Not sponsored, I just LOVE this app).

As soon as I get paid, I make my budget, divide my money in my envelope app, and live and die by the app. A screen shot of what the app looks like is below. At a moment’s glance, I can see how much I have to spend in any given budget category.

If you don’t have an iPhone, there are plenty of other budgeting and envelope apps out there that will do this exact same thing—each with it’s own unique functions and features. Find one you love!

If you don’t want to use an app, you can also divide your money using real cash envelopes. Some banks even allow you to create multiple sub accounts, and you can divide your money that way.

Choose whatever method you want, but just divide your money according to your zero-based budget.

STEP TEN - PAY YO’ BILLS. After you’ve made your zero-based budget for your payday, allocated all your money into categories based on your budget using virtual or cash envelopes or some other app, it’s time to pay yo’ bills.

Each payday, review your budget and pay all the bills that are due from that particular paycheck immediately. Get that money out of your account ASAP. Don’t wait. Waiting means you may risk incurring late fees for untimely payments or worse, you’ll be tempted to spend the money elsewhere.

What if I want to start budgeting in the middle of a pay period?

First and foremost, the best time to prepare your budget is before you get paid. You want a plan in place for your money before you get it, so when payday hits, you know exactly what to do with every penny.

But, if you’ve never budgeted before and are eager to get started right away, you don’t have to wait for payday. If you want to start budgeting for the very first time in the middle of a pay period, the concepts are all the same.

Determine what bills will be due between now and the next time you get paid

Determine how much money you have between now and the next time you get paid

Create a zero-based budget for the money you have now, making a plan to pay all the bills that will come due before your next payday.

When the next payday rolls around, create a zero-based budget for that money before you get paid.

Keep going until infinity with every paycheck you get.

Breathe a sigh of relief because you are finally in control of your money, telling it where to go—down to the penny!—instead of wondering where it went.

Remember, no one can write a perfect budget. Especially not when you first start out and you are brand new to budgeting.

No one can write a perfect budget. Unless you’re a fortune teller. In which case, come sit next to me, and let’s chat. For everyone else, you can’t foretell the future, and surprises are going to come your way.

You can especially not write the perfect budget when you first start out and are brand new to budgeting. Your budget will not only change month to month, but throughout the month as well. You’ll have to make adjustments. You probably didn’t budget enough for groceries, and you will have to pull from other categories. You’ll underestimate how much you spend in certain categories, and overestimate in others. That’s ok. The more you budget, the better you’ll get! Adjust your budget as you go along. Adjusting your budget as the month progresses isn’t failure, it’s just life.

Related: Eight Simple Tips to Help You Stick To Your Budget

All success in everything begins with the decision to start.

The most important thing is to just start. You’ll figure it out as you go, and you’ll get better with every budget you make!

Honestly, guys, writing about how to create a budget is so much more difficult than actually making one! I hope this blog post simplifies it all for you, but if not, and if you have any questions about creating your first (or next) budget, please leave your questions in the comments below, and I will be happy to help!