Personal Finance Challenge - March - Eliminate One Expense From Your Budget

Welcome to the Living That Debt Free Life 2019 Personal Finance Challenge!

If you are new to budgeting, paying off debt, and managing your finances, you’ve come to the right place! I’ve compiled 12 monthly challenges to get your 2019 financially on track.

Each monthly challenge contains one of the many steps I’ve taken to help me pay off debt faster.

If you’ve been paying off debt for a while, the information in these challenges is probably nothing new to you.

But, if you’re one of the hundreds who ask me each month how I’ve managed to pay off so much debt, then this is going to be so helpful to you!

The challenge is completely free to join! Each month, we’ll complete the challenge together and chat about it here on the blog in the comments down below and on Instagram.

I’ll announce each monthly challenge here on the blog and on my Instagram Page.

If you are participating, please feel free to leave a comment down below and let me know how it’s going! And, be sure to tag your challenge-related IG photos with #TDFL2019Challenge, so I can find you and cheer you on!!

Ready to get started?! Here’s this month’s challenge!

For all the monthly challenges, click HERE.

March 2019 - Eliminate One Recurring Expense From Your Budget

This month’s challenge is to eliminate one recurring expense from your budget.

If you did last month’s challenge, then you tracked your spending, and you should be starting to have a good idea of where your money goes on a monthly basis. Review your expense tracker, and see what you can eliminate to reduce your monthly expenses.

If you didn’t do last month’s challenge, that ok. You can complete these challenges at any time. If you want to, complete February’s challenge first, before forging ahead to March. Or, you can simply pull your bank statement from last month and look over your spending. What do you spend money on each month or year that you can eliminate?

Don’t know what to cut? I’ll help you out with some ideas below.

But first, consider reviewing your monthly expenses in PayPal and iTunes. If you aren’t tracking your expenses on the regular, you may be surprised at what memberships and recurring expenses you may be paying for without even knowing it.

Review Your Recurring Expenses in PayPal

When was the last time you audited your recurring payments in PayPal?

According to PayPal’s website, an automatic payment can be canceled up to the day before the next scheduled payment in order for you not to be charged. Here’s how you can cancel your recurring payments:

Log in to your PayPal Account.

Click the Settings icon next to “Log Out.”

Click the Payments tab, then click Manage Automatic Payments, under “Automatic Payments.”

Select the payment you’d like to cancel, then click Cancel.

Review Your Recurring Expenses in iTunes

Have you ever reviewed your subscriptions in iTunes? Forgotten to cancel a free trial and then got hit with a surprise charge on your bank statement? Or, signed up for a yearly subscription and then completely forgot about it by the next year when the renewal date comes around? I have, and trust me, it’s no fun. Even if you have a good handle on your monthly subscriptions, those yearly ones can definitely sneak attack you!

In this process of writing this blog post, I discovered a $69.99 yearly subscription for a graphic design app that I was using that I haven’t used in months, and don’t think I’ll ever use again. Canceled! AND a $59.99 yearly subscription to a meditation app that I really used to love, but haven’t been using as much. Canceled! I still get the use of both apps until the yearly renewal date, and if I want to re-subscribe later, I always can. But, I want that to be my choice, and NOT a charge I get hit with as a total surprise.

Here’s how to review your iTunes subscriptions:

Go to Settings > [your name] > iTunes & App Store.

Tap your Apple ID at the top of the screen, then tap View Apple ID. You might need to sign in with your Apple ID.

Scroll to Subscriptions, then tap it.

Tap the subscription that you want to cancel.

Tap Cancel Subscription to cancel your subscription, and then hit Confirm. If you cancel, your subscription will stop at the end of the current billing cycle.

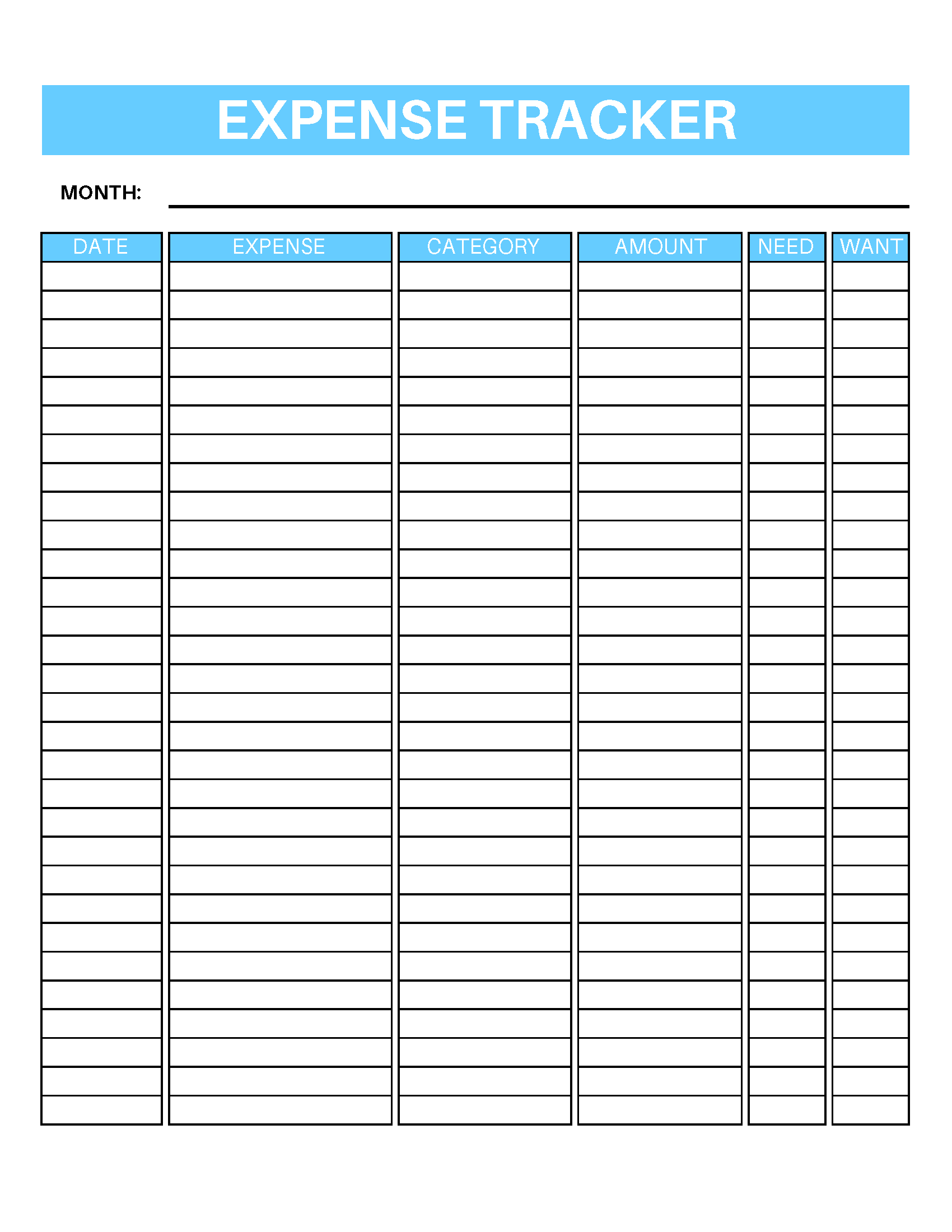

Free Printable Expense Tracker

Didn’t participate in last month’s challenge, but want to? You can get the exact Expense Tracker I use for free by clicking HERE. It lets you record each transaction, category, and amount, and it also lets you record whether the expense was a need or a want.

Ideas on What Expenses to Cut

Don’t know what to cut? Here are some ideas to get you started:

Review your recurring expenses in PayPal and cut something

Review your recurring expenses in iTunes and cut something

Satellite Radio

Cable TV (switch to something more affordable like Netflix or Hulu instead)

Gym Membership (consider working at a home with free videos from YouTube or online workouts you can just google)

Warehouse Memberships (Costco, Sam’s Club).

Amazon Prime

YouTube Premium

Audible (download the app Libby or Overdrive and listen to audio books for free from your library)

Storage Unit Fees (clear out that storage unit and sell what you don’t want/need. Use that money to send to debt!)

Streaming Music Subscriptions (Spotify, Apple Music, Pandora, Tidal, iHeartRadio). You can listen to a little commercial and you won’t die, I promise.

Monthly Subscriptions (Netflix, Hulu, Dropbox, icloud Storage, etc. (If you can’t bear to cut Netflix or Hulu, consider moving to a cheaper plan or go in with a friend or family member to reduce costs)

Monthly Box Subscriptions (Rocksbox, FatFitFun, BarkBox, BirchBox, you get the idea)

Meal Box Subscriptions (SunBasket, BlueApron, HelloFresh, Plated, Freshley, etc.)

Magazine or Newspaper Subscriptions (don’t forget digital versions)

Limit each child to only one activity (my son plays soccer every season, but that’s it. One activity means lower expenses, and more free time in our schedule because we only have one practice and one game each week).

Consider insourcing. What do you pay someone else to do for you? Can you takeover that task yourself? Examples include cutting your own hair (Yes, I know that sounds crazy, but so many people on the debt free journey actually do this with the help of YouTube and have lived to tell about it!), changing your own oil, cleaning your own home, mowing your own yard, doing your own manicures, etc.

Commit to break your expensive addictions. I have one client—a retired couple living on social security income—who spend 30% of their income on cigarettes and alcohol. THIRTY PERCENT. That’s more than the recommended percentage for your mortgage payment. They bring home plenty of money, are debt free including their home—and just can’t seem to figure out where their money is going. I took one look at their finances and told them—”I know where all your money is going. You’re drinking it and smoking it.” If you have an expensive addiction, take steps to free yourself. It can be impossible to get ahead financially otherwise.

Ready to eliminate an expense?! You’ve got this!!!

Don’t forget to tag your social media photos with #TDFL2019Challenge!! I want to encourage you and cheer you on this month, and I want to know what you decided to cut. Let me know in the comments down below or tag me on Instagram.

Then meet me back here next month for April’s challenge! Good luck, everyone!! You’ve got this!!

Oh! And, as always for bonus points, complete January’s Challenge and February’s Challenge, again this month, in connection with March’s challenge. That’s what I’m going to do!